Medicare tax calculator 2023

Click here to see why you still need to file to get your Tax Refund. Please note that the self-employment tax is 124 for the Federal Insurance Contributions Act FICA portion and 29 for Medicare.

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

Refer to Whats New in Publication 15 for the.

. Calculate your total tax due using the MN tax calculator. The 202308k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Mississippi is used for calculating state taxes due. Calculate Your 2023 Tax Refund.

Prepare and e-File your. Free SARS Income Tax Calculator 2023 TaxTim SA. It will be updated with 2023 tax year data as soon the data is available from the IRS.

While awaiting the official. How Do You Calculate Medicare Tax. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Days 101 and beyond. Up 8000 with 0 inflation. It will be updated with 2023 tax year data as soon the data.

With 0 inflation from July 2022 to August 2023 the first tier IRMAA is projected to increase from 194000 for year 2023 to 202000 for year 2024. Estimate my Medicare eligibility premium. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

The exact amount of your tax payable or refund can only be calculated upon lodgment of your income tax return. Return filed in 2023 2021 return filed in 2022. What is a 20232k after tax.

Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Based on the Information you entered on this 2021 Tax Calculator you.

The FICA portion funds Social Security which provides. If you dont see your situation contact Social Security or the. Tax Planning Consideration for IRMAA 2023.

Rising inflation coupled with a 145 Medicare Part B premium increase from 2021 to 2022 raises concerns about Medicare premiums in 2023. Self-employed people are allowed to deduct their health insurance premiums on Schedule 1 of the 1040 form as an above the line deduction. You may get a reduction or exemption from paying the Medicare levy depending on.

2 hours ago Brackets based on an average of 200 will be higher than brackets based on an average of 150. 2021 Tax Calculator Exit. Heres what you need to know.

2021 Tax Calculator Exit. Employers and employees split the tax. As of 2022 the Medicare tax is.

2022 2023 2024 Medicare Part B IRMAA Premium MAGI. 0 for covered home health care services. People who owe this.

For both of them the current Social Security and Medicare tax rates are 62 and 145. Every month while you generate income in any way you have to pay these taxes which contribute to the benefits you can enjoy after retirement. 2022 Tax Return and Refund Estimator for 2023.

You pay all costs. Get an estimate of when youre eligible for Medicare and your premium amount. This calculator includes the 38 Medicare contribution tax on the lesser of a net investment income or b modified adjusted gross income exceeding a threshold based on your tax filing.

For earnings in 2022 this base is 147000. 19450 copayment each day. The wage base limit is the maximum wage thats subject to the tax for that year.

The Medicare Tax is an additional 09 in tax an individual or couple must pay on income thresholds above 200000 for singles and 250000 for couples. The Medicare levy is 2 of your taxable income in addition to the tax you pay on your taxable income. 2023202 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations.

Medicare Part B Premiums Could Be Lower In 2023 Here S Why

Could 2023 Social Security Cola Hit 9 Benefitspro

Yes Social Security S Cost Of Living Adjustment For 2023 Is Expected To Be Higher Than Average Youtube

2023 San Francisco Hcso Expenditure Rates Released

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

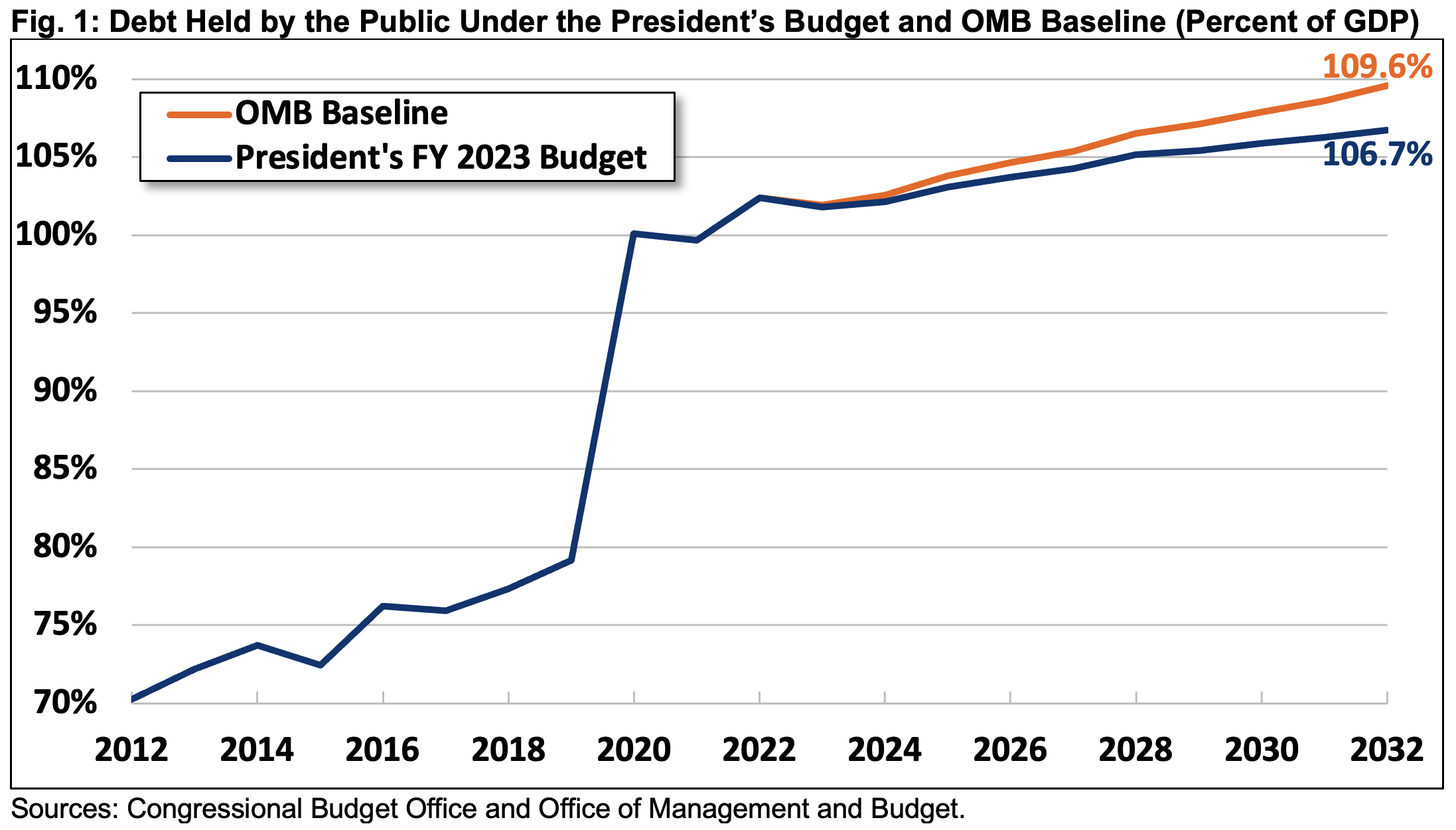

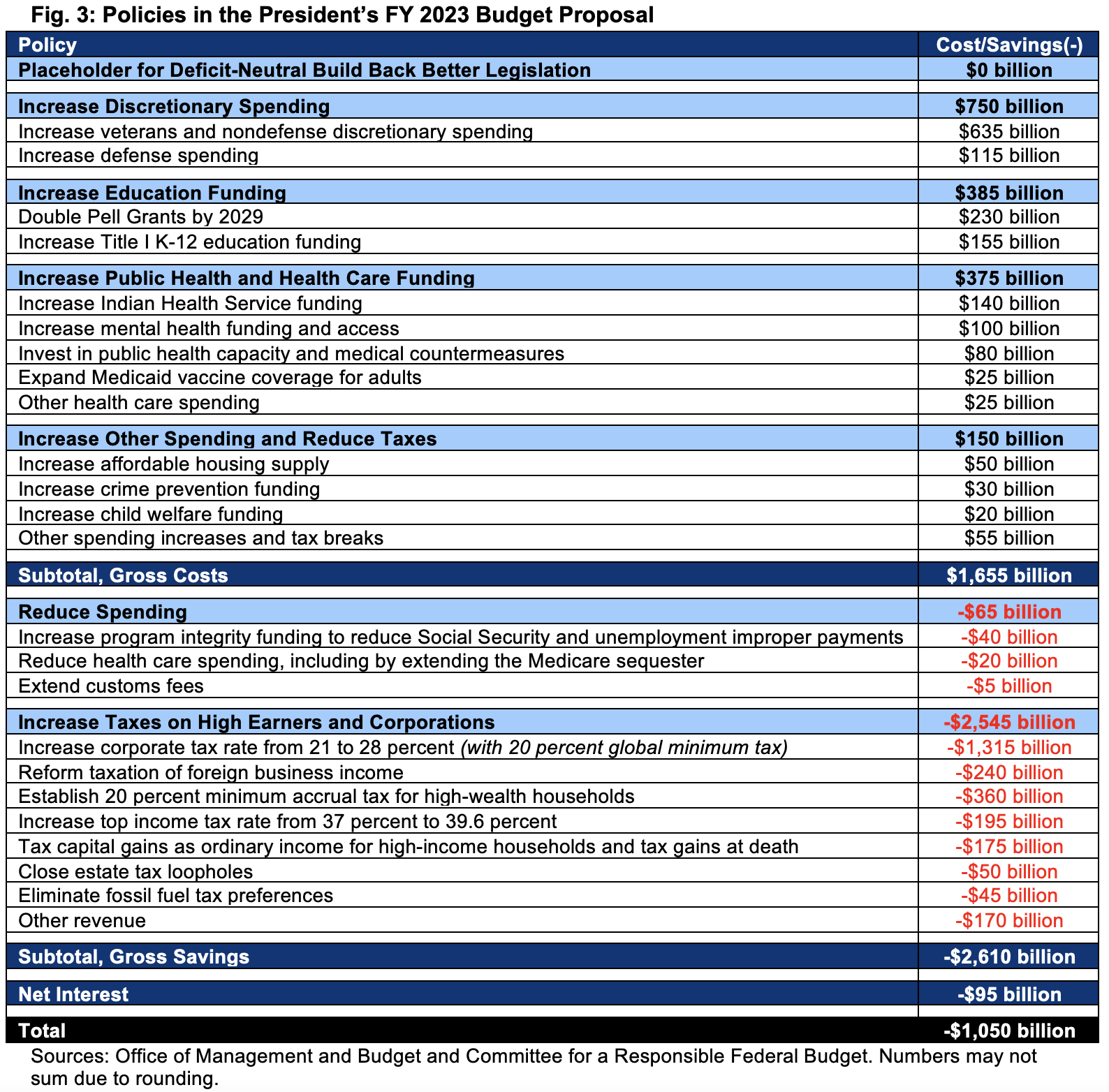

Analysis Of The President S Fy 2023 Budget Committee For A Responsible Federal Budget

2023 Lexus Rx Adds Turbos Electrical Power

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

Biden S 5 79 Trillion 2023 Budget Proposal Would Also Expand Regulation

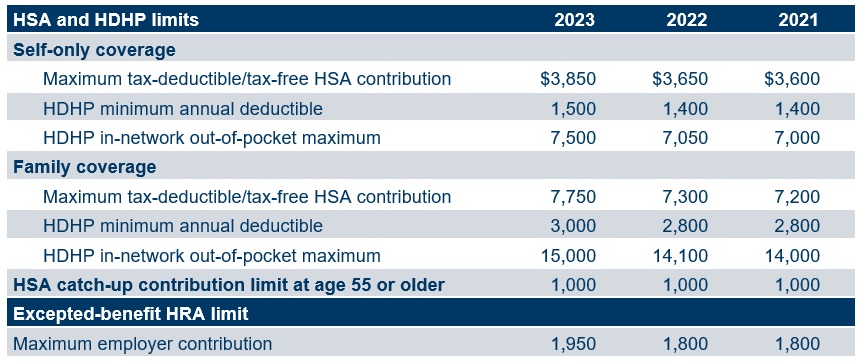

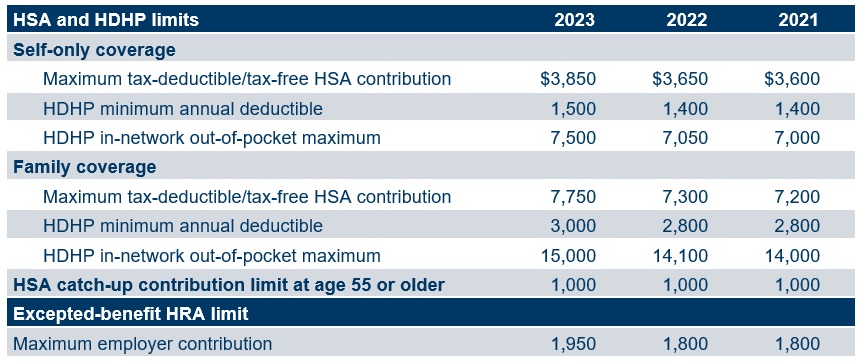

2023 Hsa Hdhp And Excepted Benefit Hra Figures Set Mercer

Coding For Pediatrics 2023 A Manual For Pediatric Documentation And Payment 9781610026406 Medicine Health Science Books Amazon Com

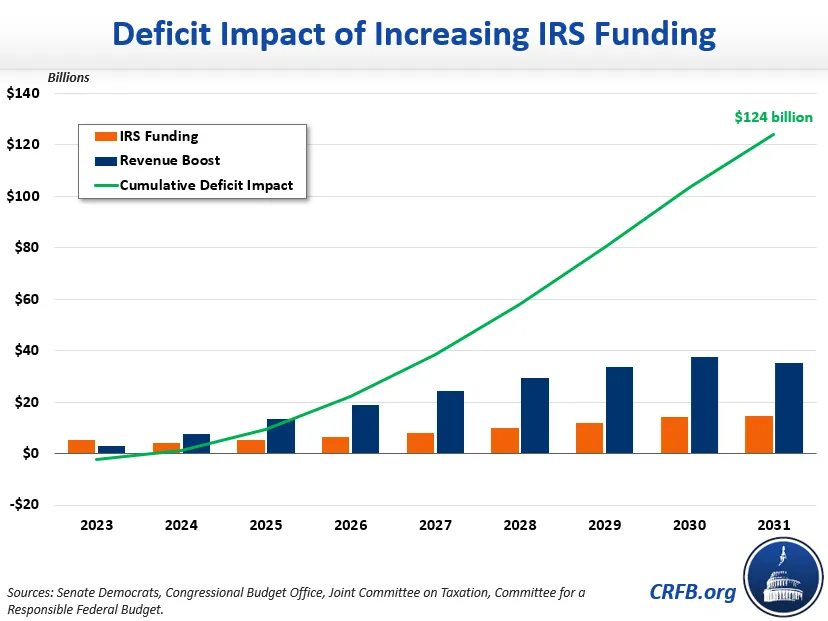

The Inflation Reduction Act Would Reduce The Tax Gap Committee For A Responsible Federal Budget

Social Security Benefits 2023 When Will The Cola Increase Be Decided Marca

Social Security What Is The Wage Base For 2023 Gobankingrates

4 Social Security Changes To Expect In 2023 The Motley Fool

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

Analysis Of The President S Fy 2023 Budget Committee For A Responsible Federal Budget